|

Step 1 - Collect your tax slips and receipts

Collect your tax slips and receipts, e.g., T4, T5, T3, foreign income slips, RRSP receipts, donation receipts, child care receipts, ....

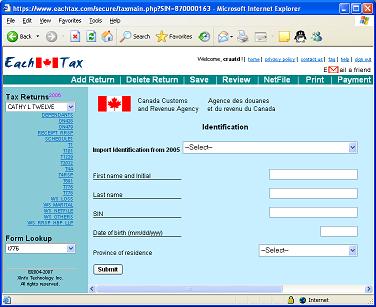

Step 2 - Click "Add Return" to add a new return

Use the Add Return command to create a new tax return. You will need to fill in all required identification information.

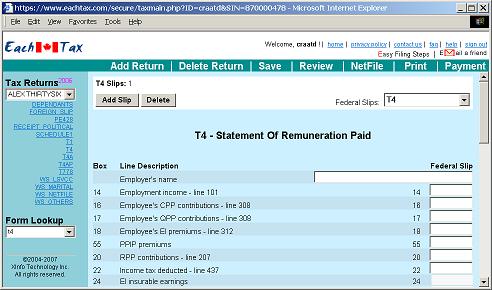

Step 3 - Fill in tax slips and receipts

Use " Form Lookup" dropdown list to find the tax slips (e.g., T4, T5, ...) or receipts (e.g., RRSP, ...) and fill in the numbers as shown on the tax slips or receipts that you have collected. AutoFillreturn is available for tax slips.

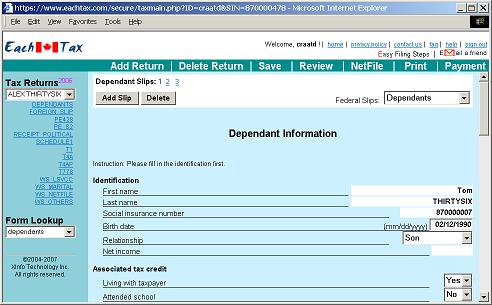

Step 4 - Fill in dependants' information

If you have dependants, use " Form Lookup" to select "dependants" worksheet and fill in dependants' information

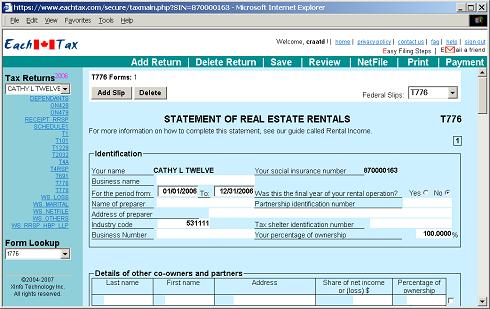

Step 5 - Report income from investment, property rental and/or self-employment

Please use " Form Lookup" to find the proper form to report each applicable income, e.g., Schedule3 (investment), T776 (rental), T2125 (business or professional activities), T2024 (farming), T2121 (fishing), ...

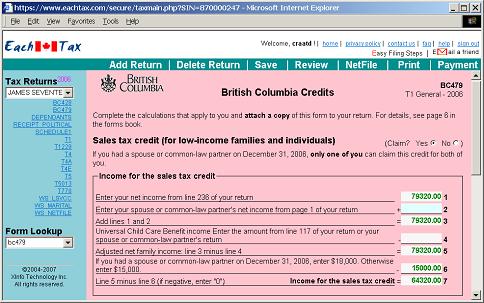

Step 6 - Claim provincial and federal tax credits

Tick various checkboxes on the provincial (e.g., provincial form 428/479) and federal tax forms as listed in the navigation area to claim applicable tax credits.

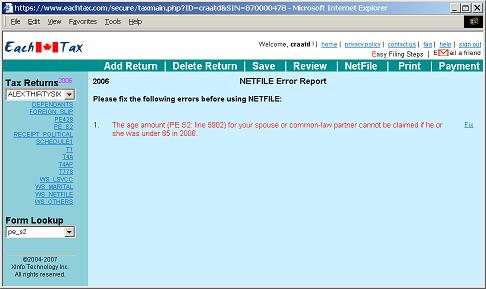

Step 7 - Click "Review" to review the tax return

You must fix all the errors identified by EachTax.com web application before you can proceed to NetFile your return(s). Please also review each warning (reminder) message to make sure that your return is complete and no information is missing.

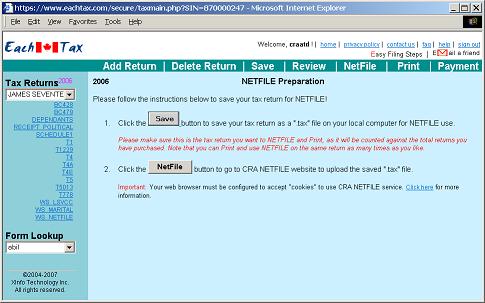

Step 8 - NetFile your return

Click the " NetFile" button and follow the instructions to file your return to CRA.

|